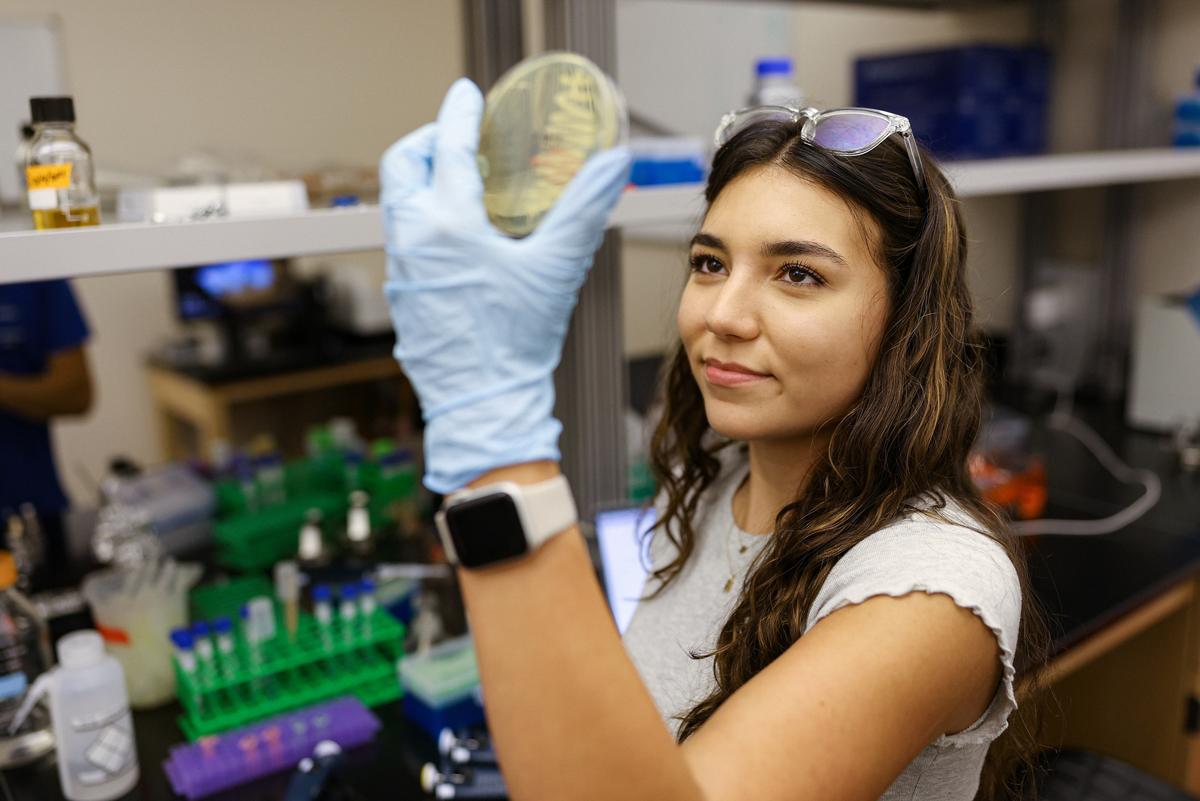

American Addiction Centers had it good: in under a year of trading publicly on the stock market, it had doubled its price per share to over $40. But on the morning of Aug. 4th, 2015, after sitting at $37.45 per share the previous day, the price plunged to below $20. The person who caused the drop was checking more than just market prices – he was also checking his textbook prices for the fall semester.

Senior economics and English major Chris Drose triggered the plummet with a post on his website, Bleecker Street Research, alleging the AAC had been covering up a murder investigation that it was a plaintiff party in.

“While AAC’s president and the company being indicted for murder was huge, what really caused the large drop was the discovery of a county court document which proved that AAC knew about the investigation since 2013 and never once disclosed it,” Drose said. “Once you can’t trust management of a public company, shareholders will bail immediately.”

His post was picked up by the Wall Street Journal soon after being published, and earned him a spot on this year’s fifth-annual Forbes “30 Under 30” list. The catalog showcases “America’s most important young entrepreneurs, creative leaders and brightest stars,” according to the Forbes website. Drose was featured in the finance section and was the youngest in the field to be recognized.

When the announcement was made, however, the 21-year-old nominee was busy analyzing a three-foot putt.

“I was playing golf with some friends, and when I got off the course I looked at my phone and saw a bunch of congratulatory texts,” Drose said. “At first I thought something else happened with AAC, but then I realized was Forbes ‘30 Under 30.’”

The writeup for his entry reads, “Furman University senior founded a stock research outfit that specializes in short ideas. His detailed report on American Addiction Centers caused the company’s stock to fall by as much as 50 [percent] in August to levels from which it has still not recovered.”

Drose has not always had his eye on the stock markets. His interest came about at Furman during a first-year seminar with Dr. Tom Smythe in the business department on market bubbles. His posts last semester on DH Healthcare and Chanticleer Holdings speak to his literacy on the topic, arguing with hard data that the companies were overpromoting and underproviding.

Finance seems complicated to many people, but Drose says that the most important thing a person can do financially is place one’s trust in the right places.

“Do your own work and don’t trust random people,” Drose said. “Make sure you know what everyone’s incentives are.”