Just down the road at Converse, another small liberal arts college in South Carolina, students are getting a break from the pricey cost of higher education. The school administration recently made the decision to decrease Converse College’s 2014-2015 tuition by 43 percent, from $29,124 to $16,500. This may spark jealousy from the students attending Furman, the most expensive private university in South Carolina, but there are drawbacks to such a reduction. Converse College is converting from a “high tuition/high discount” business model to a “low tuition/low discount” model. Converse’s new sticker price allows the school to provide less aid to incoming students. That’s one area where Furman is not lacking.

According to the Furman admissions department, about 85 percent of Furman students received some sort of financial aid last year. The average amount was around $20,000. That brings Furman’s average tuition to about $21,532, not that far from Converse’s $16,500.

Furman is part of a national trend of high sticker prices and equally high discounts offered by colleges and universities. Last year the average tuition discount hit a record high of 45 percent, according to the National Association of College and University Business Officers. Another study from Pew Research found the “money you don’t have to pay back” category increased 4 percent in the past four years for college students in America.

All these discounts do not cover up for the fact that most of the country believes college tuition is excessive. According to last year’s TIME survey on higher education, 80 percent of the general public thought the education that students receive at college is not worth the price. Not surprisingly, only 13 percent of private school officials agreed. Do the opinions of school officials matter? They aren’t the ones paying back thousands of dollars in student loans. Two-thirds of the class of 2011 held student loans upon graduation. The average borrower owed $26,600, according to a report from the Institute for College Access & Success’ Project on Student Debt. Yet Furman students don’t seem to be having a problem paying back their loans, as the school was ranked third for colleges in South Carolina with the greatest lifetime return on investment according to AffordableCollegesOnline.org.

It does not seem likely that Furman will follow in the footsteps of Converse College, given the recent increase in the amount of scholarship money provided to incoming students that led to our current budget deficit. Though next year’s tuition fees will not be decided until the trustees meet in March, the last four years can be a good indication of their decision. Each year shows about a four percent increase in tuition.

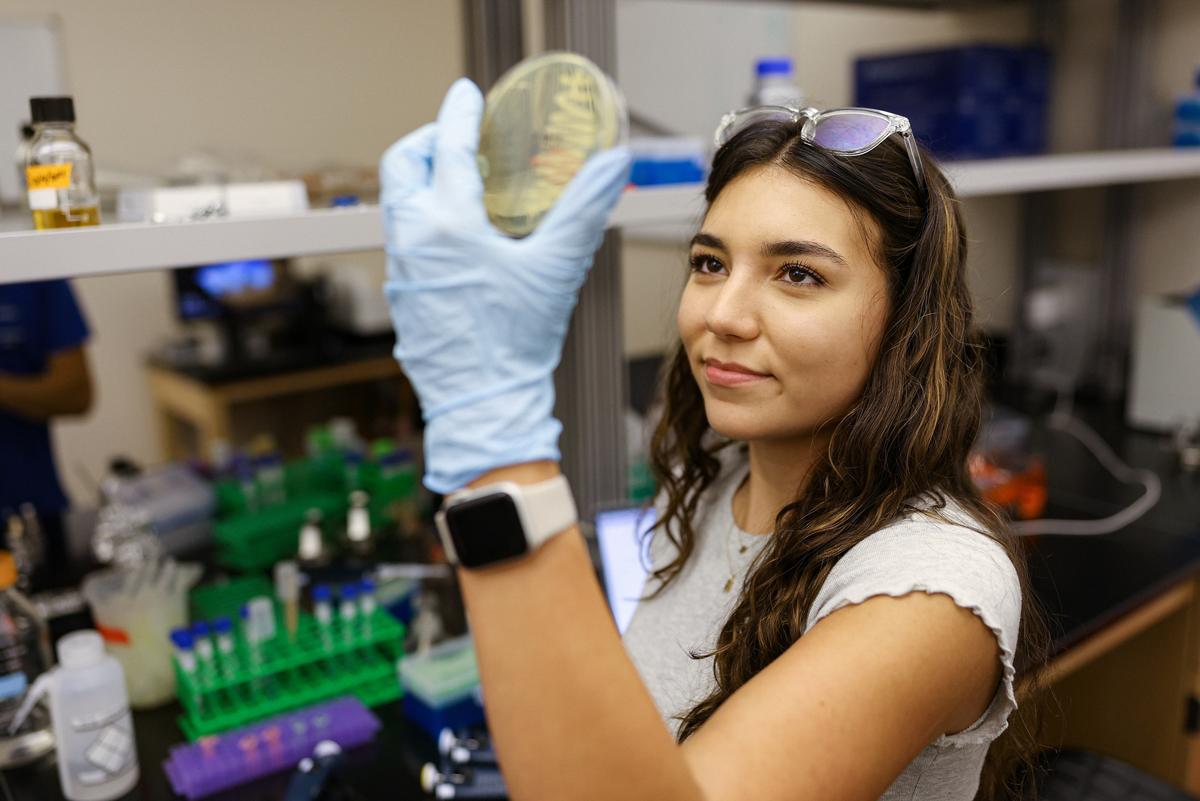

However, there are certain programs unique to Furman that help alleviate the financial burden of a private university. This past summer I received a fellowship from the Furman Advantage program, which directly funds student internships. These stipends range from $1,500 to $3,000. Another promising financial development at Furman is the recent $1 million commitment designated for need-based scholarships for students studying abroad.

So which is better for college students: high tuition and high discount or low tuition and low discount? You decide. The answer may not be as straightforward as you suppose.